Table of Contents

- Understanding Risk Adjustment and Its Purpose

- The Mechanics of Risk Adjustment in Medicare

- Balancing Costs and Care: Why Risk Adjustment Matters

- Risk Adjustment: A Tool for Fair Resource Allocation

- Evaluating the Effectiveness of Risk Adjustment Models

- The Influence of Risk Adjustment on Healthcare Quality

- Predicting Risk and Adjusting Reimbursement: The Process

- Common Challenges and Solutions in Risk Adjustment

Key Takeaways

- Understanding the basis and necessity of risk adjustment in Medicare.

- How risk adjustment facilitates the equitable allocation of healthcare funds.

- Exploring the impacts of risk adjustment on healthcare providers and beneficiaries.

Risk adjustment is often an overlooked yet pivotal component of the Medicare insurance framework. It is a strategic method used to gauge and align the allocation of healthcare funds based on the specific clinical needs of the plan members. By understanding and unraveling this concept, we can appreciate its substantial role in promoting equity and ensuring the sustainability of Medicare coverage. This complicated notion operates quietly behind the scenes but has undeniable consequences for patients and the healthcare system. In this elaborative discussion, we’ll dissect the mechanics, merits, and challenges of the medicare risk adjustment, pulling the veil back on a critical process that guides the balance between economics and the quality of healthcare coverage.

Understanding Risk Adjustment and Its Purpose

The principles of medicare risk adjustment are essential for creating a fair and balanced health insurance system. It aims to account for differences in health status among enrollees and prevent adverse selection, where insurers could manipulate their demographic mix to prefer healthier and less expensive patients. By ensuring that payments are proportional to the expected healthcare costs, this system enables people with different health needs to receive medical attention at affordable insurance rates. This meticulous adjustment is the foundation of the entire Medicare insurance model and protects it from the uncertainties of individual health variations among its members.

The Mechanics of Risk Adjustment in Medicare

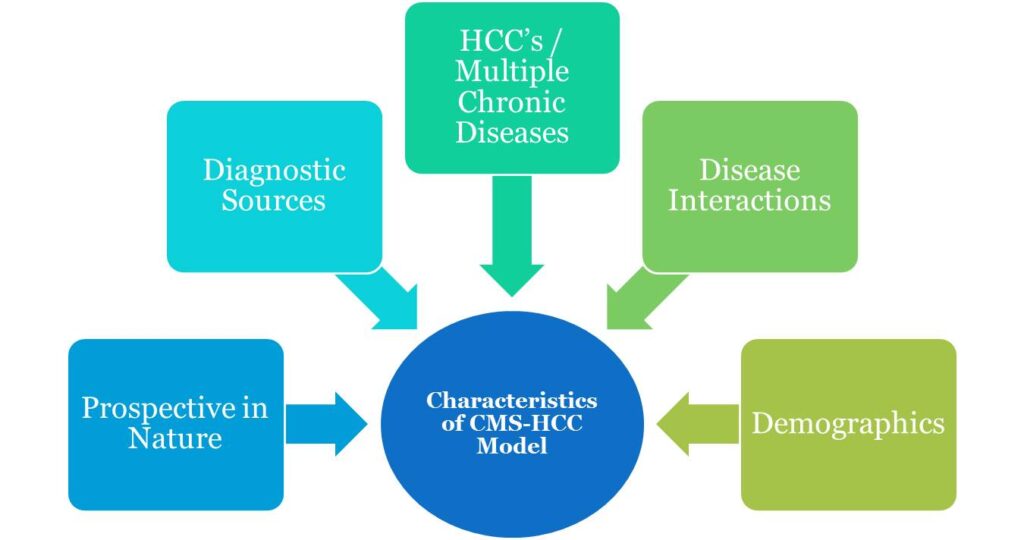

The inner workings of Medicare’s risk adjustment hinge on a formula that utilizes a broad array of demographic and health status data. Drawing on vast sets of historical and present data inputs, it outputs risk scores reflecting the anticipated healthcare cost for each beneficiary. These pivotal scores influence the payments disbursed to health plans and providers, aligning funding streams with the actual healthcare needs of patients. The calculation process is continually refined, using feedback loops to consider the most recent health trends and patient data, ensuring that payments accurately reflect and address the changing healthcare landscape.

Balancing Costs and Care: Why Risk Adjustment Matters

Risk adjustment methodologies are instrumental in shaping a healthcare system that reasonably serves collective needs. Its absence could culminate in a skewed industry landscape, where individuals with complex or chronic health dilemmas might remain uninsured or underinsured. With risk adjustment strategies in place, the financial risks associated with treating high-need patients are distributed more evenly across the healthcare ecosystem. This safeguard encourages providers to offer comprehensive and integrative care, promoting universal health coverage and minimizing disparities borne by the varying health statuses of Medicare beneficiaries.

Risk Adjustment: A Tool for Fair Resource Allocation

Healthcare providers often grapple with the challenge of serving a patient population with a vast spectrum of needs while operating within their financial constraints. Risk adjustment helps to reconcile this by serving as an equitable mechanism for resource distribution. It helps diligently identify and appraise the cost of care for patients with severe or multiple conditions, ensuring that providers who serve these individuals receive corresponding remuneration. In other words, it corrects the economic course within the healthcare market by prioritizing patient health profiles over quantity in resource allocation processes.

Evaluating the Effectiveness of Risk Adjustment Models

Evaluating the success of risk adjustment depends on how well these statistical models forecast the healthcare expenses of plan enrollees and subsequently align payments. The precision of these models has tangible repercussions, such as influencing the stability and offerings of health insurance plans, the financial health of providers, and the equitable accessibility of healthcare services. Meticulous analysis is essential in determining the robustness and reliability of these models. Scholars and policymakers continuously assess model accuracy, learning about risk adjustment models to ensure the Medicare program adapts to serve its beneficiaries most effectively.

The Influence of Risk Adjustment on Healthcare Quality

The implications of risk adjustment extend beyond mere monetary considerations, having a binding effect on the quality of care. As a critical factor in financial planning for healthcare providers, risk adjustment incentivizes them to tend to patients with involved medical conditions. It promotes an attention shift from quantity to quality, spotlighting improving patient outcomes. Thus, risk adjustments become integral in fostering superior healthcare services, ensuring that the healthcare system prizes value over volume.

Predicting Risk and Adjusting Reimbursement: The Process

Risk adjustment is never static but progressively evolves, reflecting novel insights and findings in health demographics and trends. Advanced algorithms and predictive analytics play a pivotal role in deciphering the complexities of risk adjustment. They do so by interpreting vast datasets to forecast health risks and needs, forming the backbone of a calculus that helps Medicare reconcile the delicate balance between adequate funding and coverage of its patient population. This continuous recalibration ensures that plan compensations are as closely in alignment with present-day health scenarios as achievable.

Common Challenges and Solutions in Risk Adjustment

As with many intricate systems, risk adjustment is accompanied by operational and methodological challenges. Data accuracy, the comprehensiveness of health status indicators, and the adoption of novel medical services and technologies are critical factors that underscore the complexity of administering effective risk adjustment. Addressing these potential weaknesses is crucial for refining the process, ensuring that the models are responsive to the healthcare landscape and resilient to its changes. Professionals seeking to understand and improve risk adjustment can mine for insights from examinations of these challenges in risk adjustment, which shape the future discourse in this field.